Ola Electric Mobility Share Price Target 2025: What You Want to Know?

Today In this blog, want to know more about the ola electric share price target 2025, 2026, 2027. The Equity benchmark indices Sensex and Nifty surged on Tuesday, tracking fine international developments and strong buying interest in banking shares amongst other elements. BSE Sensex jumped 827.14 factors or 1.07 percentage to touch an intraday excessive of 74,997.09.

The broader NSE Nifty climbed 243.7 points or 1.08 percent to attain 22,752.45. ICICI Bank, Zomato, Mahindra & Mahindra, Tata Motors, Larsen & Toubro, Hindustan Unilever, Power Grid and Adani Ports had been a number of the main gainers.

What You Want to Know Ola Electric Share Price Target 2025?

Key Factors Affecting Ola Electric Share Price Growth

Growing EV Market in India: With the rising demand for electric cars (EVs) and the Indian authorities’s push for clean mobility, Ola Electric has a strong boom possibility. The growing adoption of EVs can positively impact its share price.

Related Article: What Happens if I Buy Tesla Stock Today 11th March 2025?

Government Incentives and Policies: Supportive authorities regulations, subsidies, and incentives for EV producers, including the FAME (Faster Adoption and Manufacturing of Electric Vehicles) scheme, can boost Ola Electric’s production and income, using its stock increase.

Battery and Charging Infrastructure Expansion: Ola Electric is investing in battery generation and charging infrastructure, which includes its upcoming gigafactory for lithium-ion batteries. A strong charging network will improve EV adoption and decorate investor confidence.

Product Innovation and New Launches: The launch of latest electric powered scooters, motorcycles, and future 4-wheeler EVs can boom sales and marketplace presence. Continuous innovation in overall performance, design, and affordability can attract extra customers and investors.

Brand Reputation and Market Penetration: Ola Electric has built a robust brand call within the EV segment. Expanding its attain into tier-2 and tier-three towns, together with aggressive advertising and marketing, can help in scaling sales and definitely impact the inventory fee.

Read Also: Waaree Energies GMP: Innovations and Trends

Strategic Investments and Partnerships: Collaborations with battery suppliers, worldwide traders, and generation corporations can enhance Ola’s manufacturing abilties and product fine. Strong economic backing and partnerships can force long-time period stock boom.

Sustainability and ESG Trends: As worldwide buyers cognizance more on Environmental, Social, and Governance (ESG) elements, Ola Electric’s role in selling smooth energy and sustainability can appeal to institutional investments, helping its proportion charge boom.

Risks and Challenges for Ola Electric Share Price Target

High Competition within the EV Market: The Indian EV quarter is becoming exceedingly aggressive with sturdy gamers like Tata Motors, Ather Energy, and Hero Electric. Intense competition can effect Ola Electric’s market share and profitability, affecting its stock price.

Battery Supply and Costs: The availability and cost of lithium-ion batteries play a important function in EV manufacturing. Fluctuations in uncooked material fees or supply chain disruptions can increase production fees, impacting profit margins and proportion performance.

Read Also: What Are the Best Global Firms Upbeat on China’s Digital Trade Outlook?

Infrastructure and Charging Network Limitations: A lack of giant EV charging stations in India remains a major task. If Ola Electric fails to make bigger its charging infrastructure efficaciously, it could sluggish down EV adoption, affecting its income and inventory increase.

Government Policy Changes: While authorities incentives presently guide the EV industry, any reduction or withdrawal of subsidies, tax advantages, or regulatory adjustments could negatively effect Ola Electric’s financials and investor sentiment. If you want to know more guide on the best and latest ola electric share price target 2025, 2026.

Product Quality and Consumer Trust: Reports of technical problems, battery fires, or protection issues in Ola’s electric powered scooters can harm its recognition. Poor product reliability or client dissatisfaction could result in decreased demand, affecting sales and stock performance.

Financial Stability and Profitability: Ola Electric remains in its boom segment and heavily investing in production and R&D. If the organization struggles to reap profitability or faces financial losses, investor self assurance ought to decline, main to inventory charge fluctuations.

Global Economic and Market Uncertainties: Economic downturns, inflation, and fluctuations in fuel expenses can affect consumer spending on EVs. Additionally, any most important inventory marketplace volatility could impact investor sentiment towards Ola Electric’s shares.

Ola Electric's Response and Stance

Ola Electric Mobility said that it firmly contests the allegations raised through Rosmerta Digital Services. The company has sought right legal suggest and has assured stakeholders that it's going to take all essential and appropriate measures to safeguard its interests and project the claims inside the aforementioned case.

It was additionally revealed that ultimate month, Ola Electric indicated that it changed into in the technique of renegotiating its agreements with its partners, inclusive of Rosmerta Digital Services Pvt Ltd., to lower expenses and enhance the efficiency of the registration method.

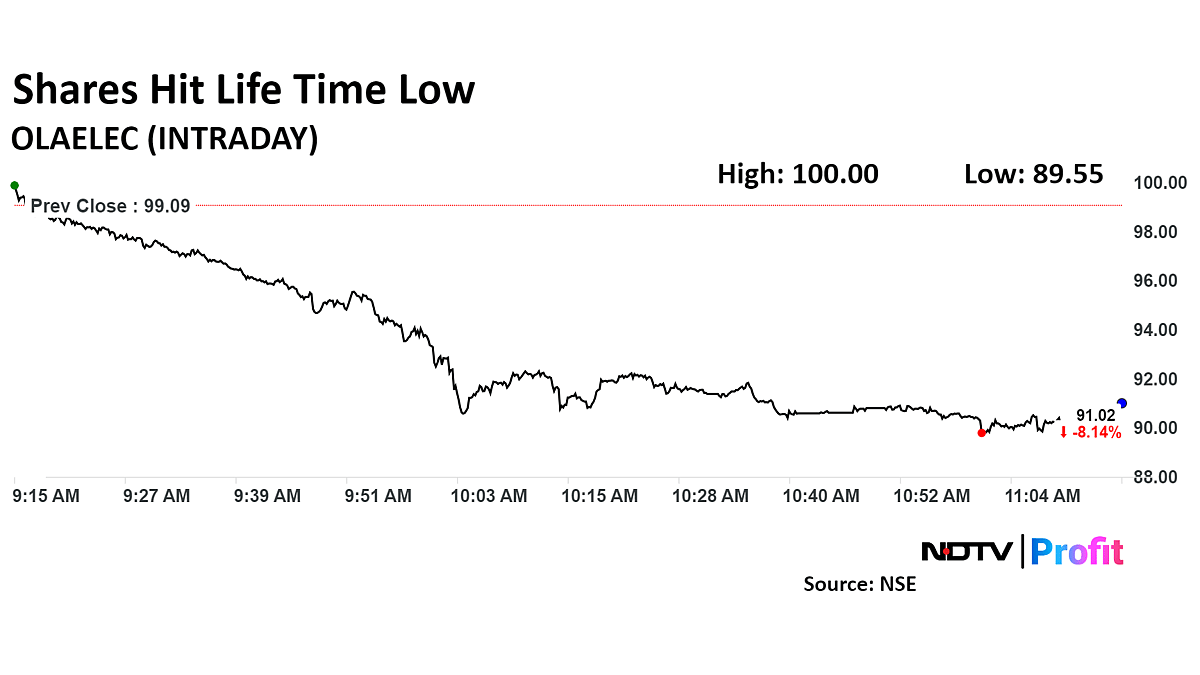

Market Analysis of Ola Electric's Share Performance

According to Anshul Jain, Head of Research at Lakshmishree Investment and Securities, Ola Electric's proportion rate has broken underneath its IPO base low of ₹seventy six.

Indicating a bearish shape characterized by continually decrease highs and decrease lows. Jain cited that once a post-IPO excessive of ₹157, the inventory has been in a firm downtrend, and with the destroy under ₹76, the subsequent key extension goal is ₹34, predicted in the coming weeks.

Read Also: How to Avoid Capital Gains Tax on Cryptocurrency?

He suggested investors to stay cautious as the downtrend appears to be firmly in control until a strong reversal emerges. The 12 months-to-date decline in Ola Electric shares is mentioned as 41.39%, with a 54.71% drop over the last six months and a forty six.

Thirteen% fall in the final three months. In the ultimate month by myself, the rate has fallen with the aid of 21.34%. On the day of the information, the share fee opened at ₹50 apiece on the BSE, reaching an intraday excessive of ₹50.16 and a low of ₹48.6. On the previous Thursday, the inventory had closed at ₹50.54 on the BSE, marking a 1.12% decrease.

Ola Electric's Financial Performance

In the 0.33 quarter that ended on December 31, 2024, Ola Electric Mobility announced a widening consolidated net loss of ₹564 crore. This boom in loss in comparison to the ₹376 crore net loss within the identical sector of the previous yr was attributed to decreased revenue because of elevated competition and one-time expenses associated with resolving service-related issues.

The sales from operations for the third area turned into ₹1,0.5 crore, down from ₹1,296 crore inside the earlier-yr region. Despite the monetary setbacks, the organization mentioned reaching its "highest-ever e2W registrations at 3.33 lakh units" during this region, representing a 37.5 percentage increase as compared to the same duration remaining 12 months.

FAQ's- Ola Electric Share Price Target

Is Ola Electric share right to buy?

As of December 2024, promoters held a 36.78% stake within the organization. It may be cited that Ola Electric shares have been on a downward spiral, plunging over 45% yr-to-date. Over six months, the inventory has lost 60%, even as the beyond month has visible a almost 23% decline.

What is the target fee of Ola Electric in 2030?

The long term outlook of Ola Electric appears to be incredibly superb, concentrated on ₹350 – ₹420 for the stocks in 2030. This increase is resulting from: Leadership in Electric Mobility: Taking the dominant function in global electric powered automobile markets.

Why is Ola Electric share fee falling?

Ola Electric Share Price Decline by four% Amid Insolvency Petition. Ola Electric's proportion rate skilled a huge drop following the statement that Rosmerta Digital Services Ltd. Intends to report for insolvency towards Ola Electric Technologies Pvt Ltd., a wholly-owned subsidiary of Ola Electric Mobility Ltd.

Has Ratan Tata invested in Ola Electric?

He invested inside the EV enterprise in May 2019 as a part of the enterprise's Series A round. Ola Electric is a part of the cluster of startups in Tata's portfolio which have hit the public markets, although. RNT Associates, Tata's VC company invested INR 14 Cr in Ola Electric soon after its inception.

Who are the main traders in Ola Electric?

Ola Electric has 39 institutional investors inclusive of Edelweiss, SoftBank and Tiger Global Management. SoftBank Vision Fund is the most important institutional investor in Ola Electric share price. Ratan N Tata and 28 others are Angel Investors in Ola Electric.

What befell to Ola Electric?

Ola Electric's registrations have crashed to just eight,390 devices — the lowest due to the fact that August 2022. That's a sixty five% drop from 24,376 units recorded in January 2024. And whilst Ola is still leading the p.C., its opponents are catching up speedy. Now, the whole electric powered two-wheeler market isn't always precisely thriving.