China Rejects u.s. Envoy’s Comment That It Hinders People-To-People Exchanges

China's unfamiliar service portrayed as "implausible" on Wednesday comments by U.S. Envoy Nicholas Consumes, saying they veered off from key understandings arrived at by the leaders of the two countries.

A Money Road Diary report broadly circled by worldwide media, opens new tab had said Consumes blamed Beijing for making individuals to-individuals trades between the two nations "unthinkable".

It isn't in accordance with the right way for China and the US to coexist with one another and isn't helpful for the sound and stable improvement of two-sided relations," unfamiliar service representative Mao Ning told a standard preparation.

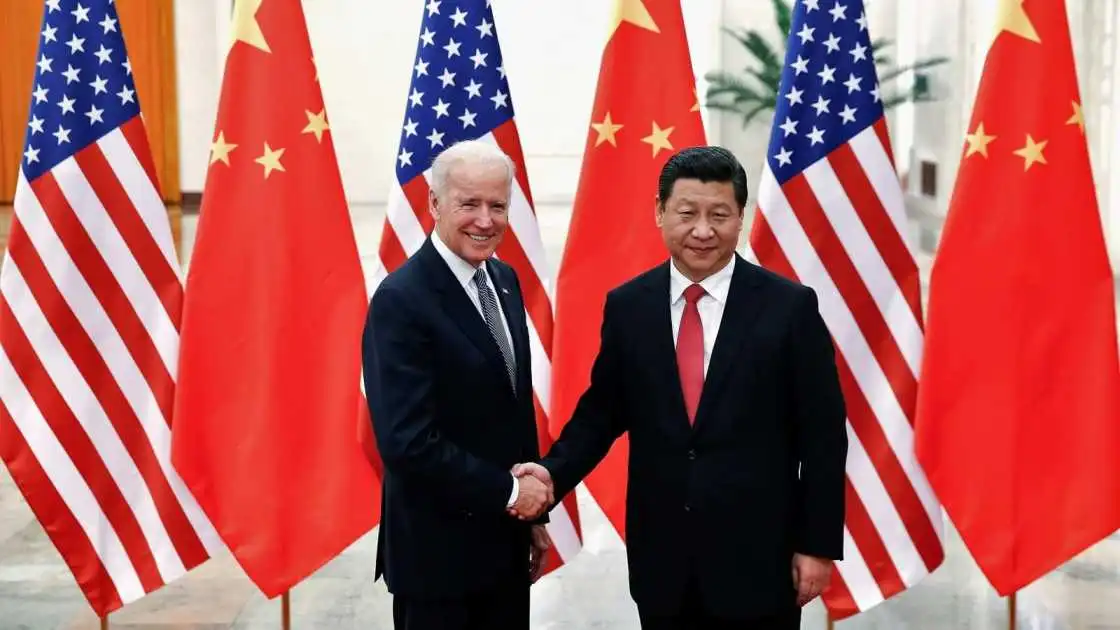

Alluding to a gathering in San Francisco last November at which Chinese President Xi Jinping and U.S. President Joe Biden examined issues that had stressed ties, Mao added:

Diplomat Consumes' comments are false and stray from the significant agreement arrived at by the two heads of state. In selections of a meeting distributed in the Money Road Diary, Consumes said central area authorities meddled in 61 public occasions coordinated by the U.S. government office in Beijing since November.

They did this either by forcing Chinese residents to remain away or attempting to scare the people who did, he added. China has consistently fostered its relations with the US as per the standards of common regard, serene conjunction and mutual benefit participation set forward by President Xi Jinping," Mao said.

The review discoveries stand out from a new report by Goldman Sachs Gathering Inc., which said its clients in China are progressively doubtful about the viewpoint for trade development in the approaching quarters.

Financial backers are stressed over the manageability of supply-side development, particularly when homegrown interest is feeble, and the dangers of exchange contact, the bank said in the note dated June 23.

Financial experts have pared back their assumptions for retail deals development - a critical measure of purchaser spending - as well as buyer and plant entryway cost expansion this year, reflecting cynicism over interest as a sharp lodging compression keeps, as per the Bloomberg review.

Late large scale information affirm that hauls from the property area remain," said Arjen van Dijkhuizen, senior financial analyst at ABN Amro Bank NV.

Development is as yet upheld by a more grounded force in sends out, yet outside gambles are ascending, as China's overcapacity adds to exchange disagreements, with the US and Europe attempting to safeguard key ventures.

China is probably not going to shake off deflationary tensions this year, with financial experts turning out to be more downbeat about the possibilities. They expect customer value file to rise just 0.6% this year, while maker cost list is figure to drop 1%, both debilitating from the evaluations in May.

This mirrors customers' hesitance to burn through cash in the midst of worries about their professional stability, pay prospects and falling property estimations.

Strains in the gig market are as yet burdening customer spending," said Erica Tay, a financial expert at Maybank Venture Banking Gathering. Indeed, even as the high level assembling areas are winning worldwide piece of the pie, their benefits can go such a long ways in counterbalancing the drag to Gross domestic product development from languid utilization.

Financial specialists pushed back their assumptions for a slice to the save prerequisite proportion - how much money banks should set for possible later use - to the second from last quarter from the subsequent quarter. The PBOC held off on facilitating as of late to safeguard the yuan and as market liquidity was more than adequate.

They likewise extended a more slow development of cash supply this year contrasted with May, as the national bank flagged a change in concentration to the proficiency of assets as opposed to unadulterated extension.